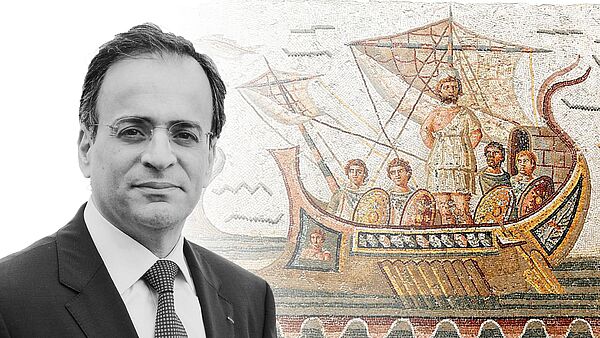

Conference in honor of Professor Elyès Jouini

© Mosaic of Ulysses and the Sirens, Bardo National Museum, Tunisia

A prominent figure in the French and international scientific community, Elyès Jouini represents a way of thinking at the intersection of disciplines, where mathematics, economics, and finance meet. A former student of the École Normale Supérieure (rue d’Ulm), top-ranked in the national mathematics agrégation, and holder of a PhD and an HDR from the University of Paris 1 Panthéon-Sorbonne, he first taught mathematics before becoming a leading expert in economics and finance.

He is currently Director at the Institut Universitaire de France and professor at Paris Dauphine-PSL University, after having held positions at the University of Paris 1 Panthéon-Sorbonne, ENSAE, and New York University. He has influenced generations of students and researchers, both through the rigor of his thinking and his involvement in major initiatives: from the Chair “Individuals Facing Risk” to the UNESCO Chair “Women and Science”, as well as the co-founding of academic journals and societies, such as the Bachelier Finance Society and the journal Mathematics and Financial Economics.

His scientific work, marked by a high level of intellectual rigor, explores the foundations of individual and collective decision-making, and the dynamics of interaction through market mechanisms.

His influence goes beyond academia: committed to strengthening ties between research and the professional world, he played a key role in creating several major initiatives such as the Europlace Institute of Finance, the Risk Foundation, and the Louis Bachelier Institute.

A member of the Institut Universitaire de France, of the Tunisian Academy of Sciences, Letters and Arts Beït al-Hikma, and a Fellow of the Econometric Society, SAET, and IZA, Elyès Jouini has also played an important institutional role as former Vice-President of Paris Dauphine-PSL University and President of its Foundation.

This conference will bring together many of his co-authors, colleagues, friends, and students to celebrate not only an outstanding career, but also a vision of science that is open, demanding, and deeply humanistic. It will be an exceptional opportunity to welcome internationally renowned researchers to Dauphine.

Registration

Model risk sensitivity and hedging

Nizar Touzi, New-York UniversityDistributionally robust optimization studies the worst deviation of an evaluation functional on the Wasserstein ball centered at the model of interest. We derive explicit sensitivity analysis under marginal and martingale constraints which provide first order semi-static hedge against model risk.

Optimal coarse correlated equilibria in mean field games

Luciano Campi, University of MilanWe will give an overview of coarse correlated equilibria in mean field games (MFGs) in continuous time, focusing on a specific example (where Nash MFG solutions do not exist) and on the linear-quadratic case. If time allows, we will also discuss how to construct approximate equilibria in the corresponding N-player games and some future developments, such as the computation via learning algorithms of optimal coarse correlated MFG solutions from the point of view of a moderator. This talk is based on joint works with F. Cannerozzi, F. Cartellier, and M. Fischer, and on a work in progress with F. Cannerozzi and I. Tzouanas.

Projective sets and robust finance

Laurence Carassus, Centrale SupélecTraditional approaches in financial mathematics and economic theory assume a single probability measure to describe the evolution of asset prices; however, in a multiple-priors (or robust or Knightian) framework, uncertainty is modelled through a family of probability measures. This generalisation accounts for ambiguity and model uncertainty, making it particularly relevant in modern markets where agents may hold diverse and even conflicting beliefs about future states of the world. In the quasi-sure setting of Bouchard and Nutz, the price processes are assumed to be Borel measurable, the graphs of random beliefs to be analytic sets, while trading strategies and stochastic kernels are only obtained to be universally measurable by measurable selection. To address this issue and solve advanced problems of portfolio choice or no-arbitrage characterisation, a key development in robust finance is using advanced set-theoretic axioms, particularly the axiom of Projective Determinacy. We propose a new setup for Knightian uncertainty that generalises the quasi-sure one of Bouchard and Nutz and is homogeneous regarding measurability requirements. This setup is based on projective sets and projectively measurable functions.

Risk Measures on Wiener Space

Hans Föllmer, Humboldt University of BerlinConvex risk measures appear in many contexts, in particular in the representation of preferences in the face of risk and Knightian uncertainty. Here we focus on their probabilistic structure. First we review alternative proofs of a fundamental result of E. Jouini, N. Touzi, and W. Schachermayer concerning the crucial Fatou property. Then we discuss risk measures on Wiener space that are defined in terms of entropies and Wasserstein distances, corresponding to Talagrand’s transport inequality and its recent rescaled version. In view of the Levy-Ciesielski representation of Wiener space as a Gaussian random field on the Cayley tree, this suggests to look at spatial risk measures on general random fields, and at the mathematical interplay between local and systemic risk.

Charcterizing arbitrage-free Choquet pricing rules

Bernard Cornet, Université Paris 1 Panthéon-Sorbonne and Kansas UniversityThe theory of asset pricing has traditionally been developed under the dual assumptions of frictionless markets and the absence of arbitrage opportunities. To account for a broader range of frictions present in financial markets, pricing rules have been studied within a subadditive framework. In a significant advancement, Cerreia-Vioglio et al. (2015a, 2015b) extended the Fundamental Theorem of Finance by demonstrating that, in the presence of market frictions, the validity of the put-call parity is equivalent to the representation of the market pricing rule as a discounted Choquet expectation with respect to a risk-neutral, nonadditive probability measure which may not be concave, thus establishing a pricing framework beyond subadditivity. Building on this development, the present paper advances the study of Choquet pricing rules by considering a setting where neither subadditivity nor monotonicity is assumed. We provide characterizations of arbitrage-free market pricing rules based on two equivalent conditions: (i) the existence of a linear stochastic discount factor that lies below the pricing rule, and (ii) the non-emptiness of the core of the associated risk-neutral nonadditive probability. Notably, this analytical framework also yields an alternative proof of Schmeidler’s theorem regarding the non-emptiness of the core in an infinite-dimensional cooperative game theory context.

On Future Allocations of Scarce Resources without Explicit Discounting Factors

Jean-Marc Bonnisseau, Professor Emeritus, Université Paris I Panthéon-SorbonneWe show that by merely fixing upper bounds and lower bounds for the stream of consumptions, we can compute the optimal planning of consumptions independently from an explicit sequence of discounting factors as soon as they are assumed to be strictly decreasing. The optimal solution is unique and exhibits two regimes with a pivotal period in the middle. The same principle applies to future reimbursements of a debt as soon as we assume discounting factors to be strictly increasing. Therefore, one gets plans satisfying some kind of intergenerational fairness since: the highest effort is supported by the first generations and then it decreases for the remaining ones. Furthermore, we show that the solution is time consistent and we study the link with the standard discounted utilitarian model.

A mean-field game of market entry - Portfolio liquidation under trading constraints

Ulrich Horst, Humboldt Universität zu BerlinWe consider both N-player and mean-field games of optimal portfolio liquidation in which the players are not allowed to change the direction of trading. Players with an initially short position of stocks are only allowed to buy while players with an initially long position are only allowed to sell the stock. Under suitable conditions on the model parameters we show that the games are equivalent to games of timing where the players need to determine the optimal times of market entry and exit. We identify the equilibrium entry and exit times and prove that equilibrium mean-trading rates can be characterized in terms of the solutions to a highly non-linear higher-order integral equation with endogenous terminal condition. We prove the existence of a unique solution to the integral equation from which we obtain the existence of a unique equilibrium both in the mean-field and the N-player game. This talk is based on joint work with Guanxing Fu and Paul Hager.

Lacunary/Hereditary Limit Theorems in Probability and Analysis

Walter Schachermayer, University of ViennaJ. Komlos proved in 1967 an extremely useful theorem. For any bounded sequence (f_n) in L^1 there is a subsequence n_k and a limiting function f such that f_{n_k} converges to f almost surely in Cesaro mean. The convergence not only holds for the subsequence f_{n_k}, but also for each of its sub-subsequences. This important result may be seen as an extension of the strong law of large numbers, pertaining to arbitrarily dependent sequences of random variables. We analyze also other lacunary/hereditary versions of classical variants of the law of large numbers. Special attention will be given to the law of large numbers of Hsu-Robbins-Erdös from 1947/49. We show that it is indispensable for the proof of a lacunary/hereditary version of this theorem to use approximations by exchangeable sequences of random variables (as opposed to martingale differences). This yields the first example verifying a conjecture by D. Aldous from 1977.

Supporting the functionality of government bond markets

Darell Duffie, Stanford UniversityGovernment bond markets have been showing cracks under stress. This presentation will show evidence of a growing imbalance between the supply of bonds and the peak intermediation capacity of dealers. Drawing on a case study of the U.S. Treasury market, this talk focuses on intermediation bottlenecks and relevant policy approaches.

Skewness Preferences in Choice under Risk

Paul Karehnke, ESCP Business SchoolSkewness preferences—preferences toward low-probability, high-impact risks—are crucial determinants of economic behavior. This paper defines first- and higher-order skewness preferences and shows that the order of skewness preference captures the importance of skewness relative to mean and variance. While leading theories of choice under risk largely agree on the direction of skewness preference, they disagree on the order. In expected utility, skewness-seeking cannot be first-order—an impossibility result—which motivates the use of behavioral theories in economic modeling.

Belief Skewness in the Stock Market

Arthur Beddock, City University of Hong KongBelief skewness—the asymmetry in investors’ cash-flow growth rate expectations—has a negative impact on the stock mean return, controlling for the average bias in beliefs and belief dispersion. When investors are sufficiently optimistic on average, however, the relationship reverses. Belief skewness also has a positive impact on the stock price and a negative impact on the stock volatility. To show this, we first develop a continuous-time general equilibrium model with heterogeneous investors having skewed beliefs. We then use analyst forecast data to construct belief skewness proxies and verify the model implications for the aggregate market returns empirically.

Belief-Efficient Markets under Knightian Uncertainty

Frank Riedel, Bielefeld UniversityHeterogeneous beliefs among market participants can lead to questionable speculative trading that goes beyond any risk-sharing motives. We demonstrate that such unwarranted betting behavior in market equilibrium can be mitigated by introducing nonlinear pricing for ambiguous contracts, without compromising legitimate risk-hedging activities. While Arrow-Debreu equilibria generally fail to achieve belief-neutral efficiency, we establish a modified version of the first welfare theorem in which equilibria with nonlinear prices uphold belief-neutral efficiency. Moreover, we show that belief-neutral efficiency, as a regulatory criterion, can be ensured by introducing transaction costs.

- Gender gaps in STEM: A quick review of possible causes and remedies

Thomas Breda, Paris School of Economics and Institute of Public Policy

Based on joint work with Elyès Jouini, the talk will review the possible causes of the underrepresentation of women in STEM fields, covering discrimination in male-dominated fields, gender differences in academic performance, and the role of stereotypes and social norms in shaping gender differences in educational choices. It will then briefly discuss possible remedies, e.g. how role model interventions may be designed to be effective in changing these choice.

- Emission prices, biomass and biodiversity in tropical forests

Jose Scheinkman, Charles and Lynn Zhang Professor of Economics, Columbia University

We investigate how external emission prices influence robustly optimal reforestation in the Brazilian Amazon and the biodiversity impacts. Extending the findings of Assuncao et al. (2023), we revisit their spatial-dynamic model of land allocation under uncertainty. Their analysis reveals that financial transfers of $25 per ton of CO2e can shift the Amazon from emitting 17 gigatons of CO2e to capturing 18 gigatons over 30 years. Our study expands this work by integrating scientific insights to evaluate biodiversity outcomes, highlighting the broader ecological benefits of emission pricing as a mechanism for achieving both carbon sequestration and biodiversity conservation.

Useful Information

Dates :

From Wednesday 4 June 2025

at 8:50 am

to 5 June 2025

at 4:00 pm

Location : Salle A709

- Seminar Gender Behavior and Decision-Making, with Gabriella Conti

202529Apr

- Ownership, Control, and Performance

![[Translate to EN:] [Translate to EN:]](https://static3.dauphine.psl.eu/fileadmin/_processed_/d/7/csm_visuel_chaire_entreprises_b4eff705f2.png)

202516Jun202517Jun